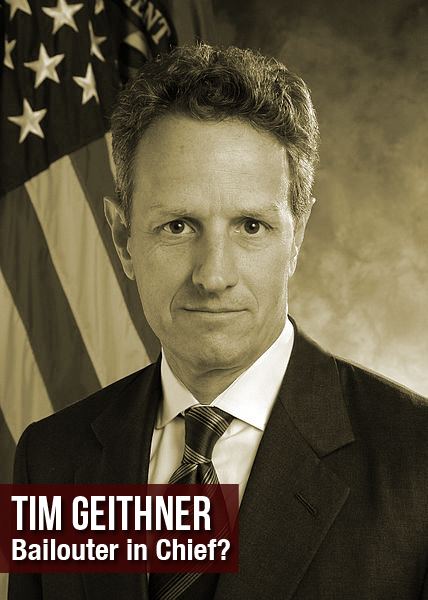

Sheila Bair Tim Geithner Quotes - Background

In January 2009, Geithner was voted in as Treasury Secretary, even though he had failed to pay Social Security and Medicare taxes for several years.

Around that time, Geithner claimed before Congress that he had “never been a regulator,” even though he’d just served as president of the NY Fed, which has the explicit duty to regulate Wall Street. In other words, as president of the NY Fed Geithner had been willing to use Fed money to assume the risk of loss on $30B worth of bad mortgages at Bear Stearns, but he wasn’t willing to view his job as a regulator of Wall Street. It’s no wonder then why one top banker, according to Ron Suskind’s book Confidence Men, referred to Geithner as “our man in Washington.”

According to former FDIC Chariman Sheila Bair, Geithner took every opportunity to bailout the megabanks. In fact, Bair went so far in her critique of Geithner to label him ”bailouter in chief,” and assert that Geithner “was by far the most generous in wanting to, for every solution, throw money at the problem.”

Two excerpts from Sheila Bair’s book, Bull by the Horns

About Obama’s appointment of Geithner: “I did not understand how someone who had campaigned on a “change” agenda could appoint someone who had been so involved in contributing to the financial mess.”

“Tim seemed to view his job as protecting Citigroup from me, when he should have been worried about protecting the taxpayers from Citi.”

(And one excerpt from a CNBC interview)

“I think [Geithner] viewed the problems through the prism of the large financial institutions, particularly Citigroup, and his worldview was if you help them out of their troubles you’re going to help out the economy. I wanted to impose some market accountability. I wanted bondholders to take losses, I wanted those who had lent money to these institutions, the investors, to share more of the pain and share more of the risk. I think it was just a constant conflict throughout…There was just a philosophic disagreement throughout my tenure.”